An investor enters into a short forward contract to sell 100,000 British pounds for US dollars at an exchange rate of 1.4000 US dollars per pound. How much does the investor gain

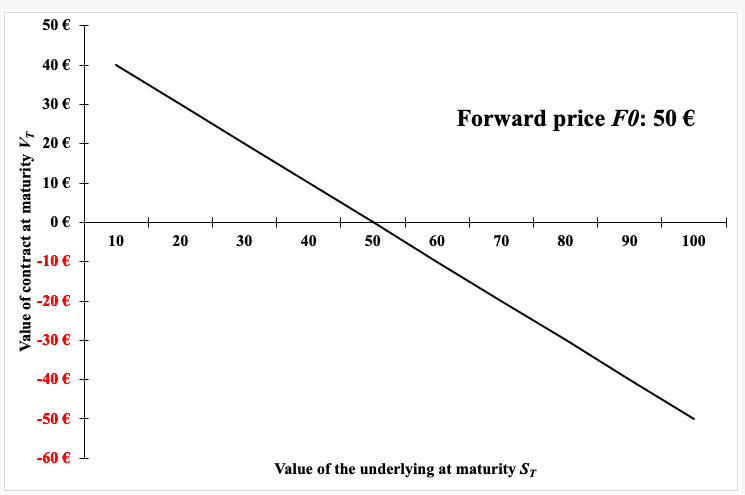

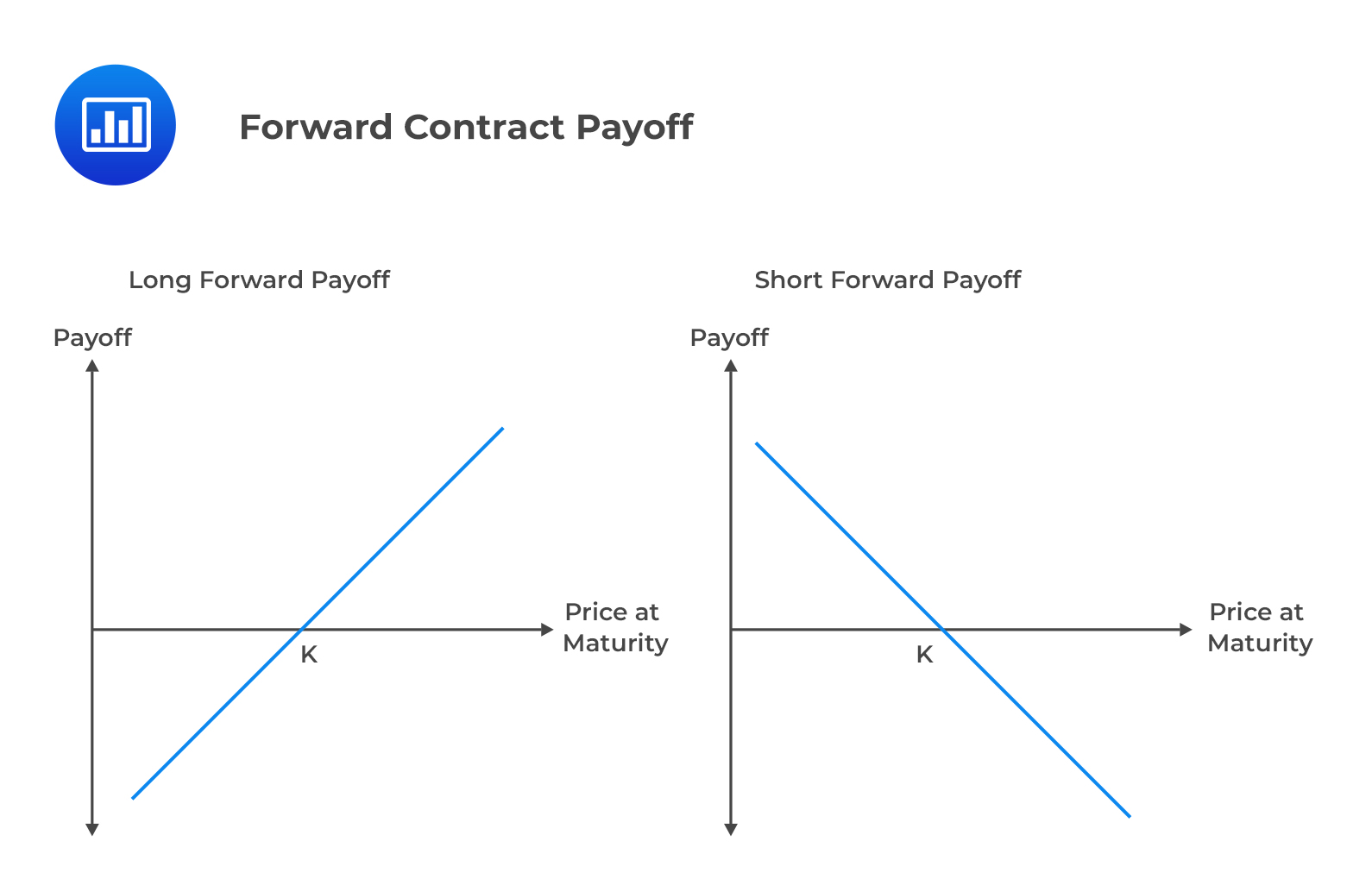

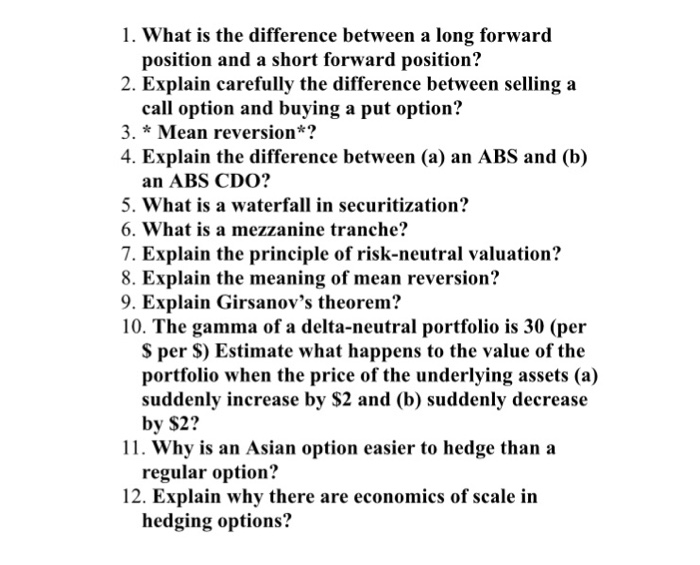

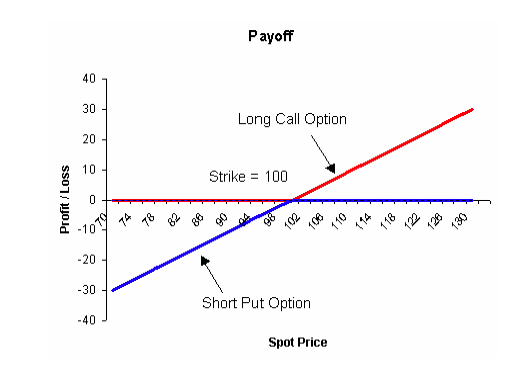

Payoff diagram of long forward and short forward Where S T is the spot... | Download Scientific Diagram

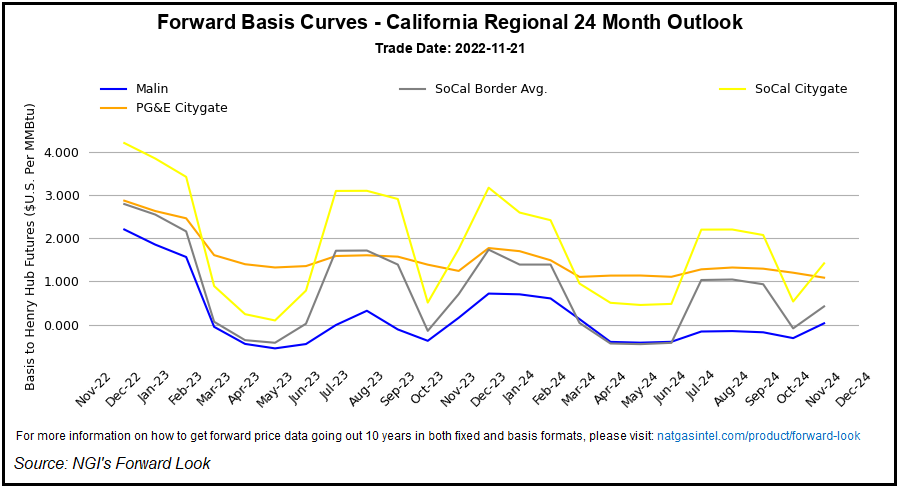

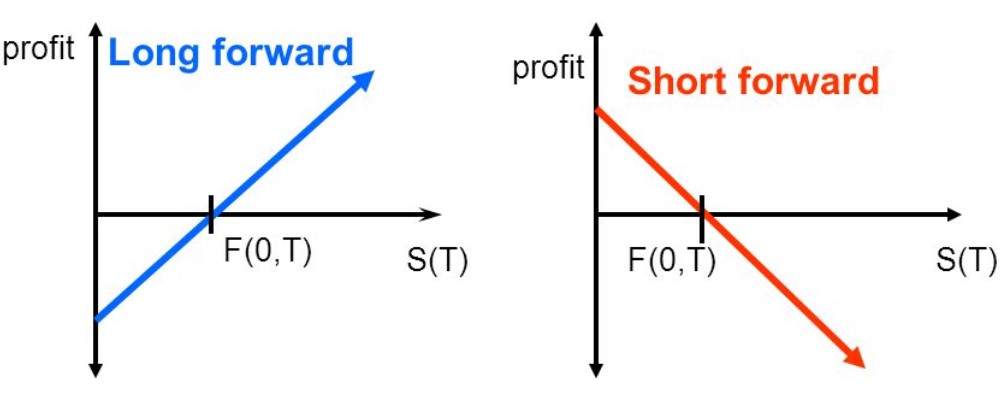

Pacific Northwest, Rockies Forward Prices Rise as Snow, Bitter Cold Stoke Demand, Storage Draws - Natural Gas Intelligence

Payoff diagram of long forward and short forward Where S T is the spot... | Download Scientific Diagram

An off-market forward contract is a forward where either you have to pay a premium or you receive a premium for entering into the contract. (With a standard forward contract, the premium

![FM] Options – II: Payoff diagrams | A Matter of Course FM] Options – II: Payoff diagrams | A Matter of Course](http://vineetv.files.wordpress.com/2013/10/payoff-diagram-forwards.png)

:max_bytes(150000):strip_icc()/ForwardContract_Final_4196098-a745f40c47f04d2fb8634295b4b8241b.jpg)